unrealized capital gains tax meaning

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. In total 215 billion could be collected over nine years with Musk paying the most at 50 billion.

Many Users Are Confused When They Try To Report Their Backdoor Roth In Turbotax This Article Gives Detailed Step By Step Inst Turbotax Roth Federal Income Tax

Bidens proposal would take the.

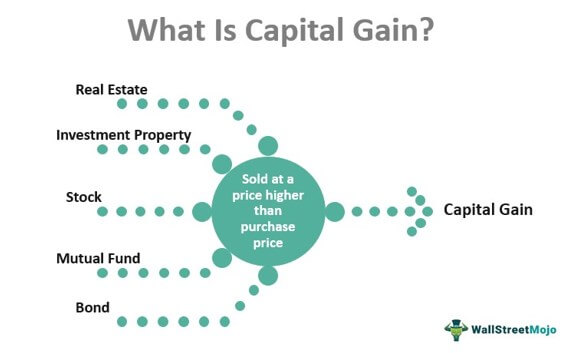

. Unrealized Capital Gains means with respect to a security or other asset the amount by which the fair value of such security or other asset at the end of a fiscal year as determined by the Company in accordance with GAAP and the Investment Company Act exceeds the original cost of such security or other asset as determined by the Company in. The Problems With an Unrealized Capital Gains Tax. The proposal would require wealthy households to remit taxes on unrealized capital gains from assets such as stocks bonds or privately held companies.

As a result there is the possibility that the paper gain might be erased if the price goes back down. Its a tax thing. Planning the tax consequences of unrealized gains and losses that are yet to be realized can help you have an overall lower tax bill.

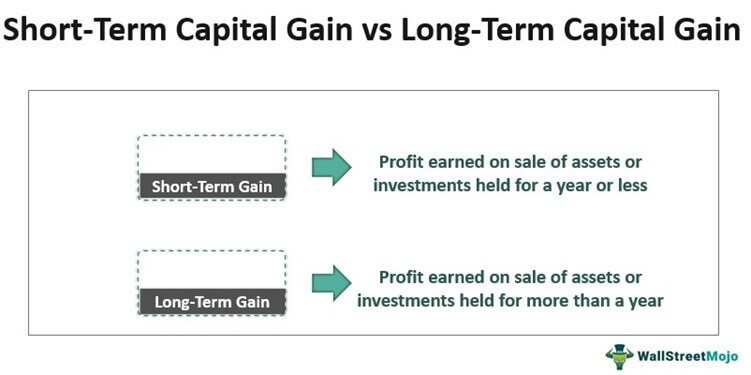

409 Capital Gains and Losses Source. The tax liability on realized gains depends on your income and how long you owned the investment. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons why any proposal to make this a reality probably wont make it too far.

Tax pyramiding obscures the impact of. In reality it is a tax on wealth. Unrealized Capital Gain means with respect to any Reference Obligation if the Current Price of such Reference Obligation is greater than the Initial Price in relation to such Reference Obligation then a such Current Price minus such Initial Price multiplied by b the Reference Amount of such Reference Obligation.

An unrealized gain is an increase in your investments value that you have not captured by selling the investment. If your capital gains are the total of your gains from stock transactions plus your box 2a from 1099-DIV everything is correct. Earn less than 80000 in taxable income if youre married filing jointly less than 40000 for single filers.

The only ways to avoid paying capital gains tax are. A gain or a loss becomes realized when you sell the investment. A new unrealized capital gains tax would be a headache to enforce.

When an investor dies their assets get transferred to their heirs at the current market rate. He bought it for 20000 from a neighbor. FTTs tax financial trades placing another tax on top of existing taxes on capital gains and corporate income.

That is a paper gain occurs when the current price of a security is higher than the price the holder paid for it but the holder still owns the security. Unrealized gains are not taxed until you sell the investment and the gain is realized. A gain on an investment that has not yet been realized.

Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. Such a tax is really a tax on wealth. While a fund that has huge unrealized gains is an indication of a fund that has been successful in picking winners it also poses potential bomb-shells for new investors in the fund.

Because there is a shortage of tractors the market price for the. Below are one economists estimates of what the top 10 wealthiest Americans would owe on their unrealized capital gains alone. He uses it on his farm.

The gain is passed to you through Form 1099-DIV and it is taxable income to you. So a concrete example will help. Answer 1 of 18.

Mutual funds with low turnover have large unrealized capital gains. Never sell an asset. If an investment is sold meaning that there is now a new owner of the investment the capital gain is considered to be realized Further if you realize a capital gain post-sale the proceeds are deemed taxable income.

While the consequences of gains mean more money to invest and losses are losses understanding when to realize your capital gains and losses can give you a better idea of how to plan out for the future. There is no unrealized gain. This week President Biden introduced a new tax proposal as part of the White House fiscal year 2023 budget to raise taxes on households with net wealth over 100 million.

The gains and losses you see in your portfolio are considered unrealized until you sell the investment. Statements to the Congress. They are realized gains from within a mutual fund or company in which you have invested.

The distinction between unrealized and realized gainslosses is an important one because there are tax implications that could impact your tax bill at the end of the. Farmer Bob has a small tractor. IRS Unrealized vs Realized Capital Gains.

The Unintended Consequences Of Taxing Unrealized Capital Gains

Capital Gain Formula And Taxes On Unrealized Realized Gains

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

The Unintended Consequences Of Taxing Unrealized Capital Gains

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gain Formula And Taxes On Unrealized Realized Gains

Capital Gain Meaning Types Calculation Taxation

What To Know About Biden S Billionaire Tax Fortune

Biden S Tax On Large Capital Gains At Death Will Catch A Few With Annual Incomes Of Less Than 400 000

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Capital Gain Meaning Types Calculation Taxation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)